VAT and Expense Reports: What You Can (Really) Recover

The 23th of May,2025

Value-Added Tax (VAT) is often seen as a neutral tax for businesses—but only when it’s properly managed. One area where VAT recovery often falls through the cracks? Employee expense reports. Whether it’s travel, meals, or fuel, companies frequently leave reclaimable VAT on the table due to lack of knowledge, poor documentation, or misclassification.

This article dives into the practicalities of VAT recovery on expense reports—and how to make sure you’re not missing out on legitimate deductions.

1. The General Rules of VAT Deductibility

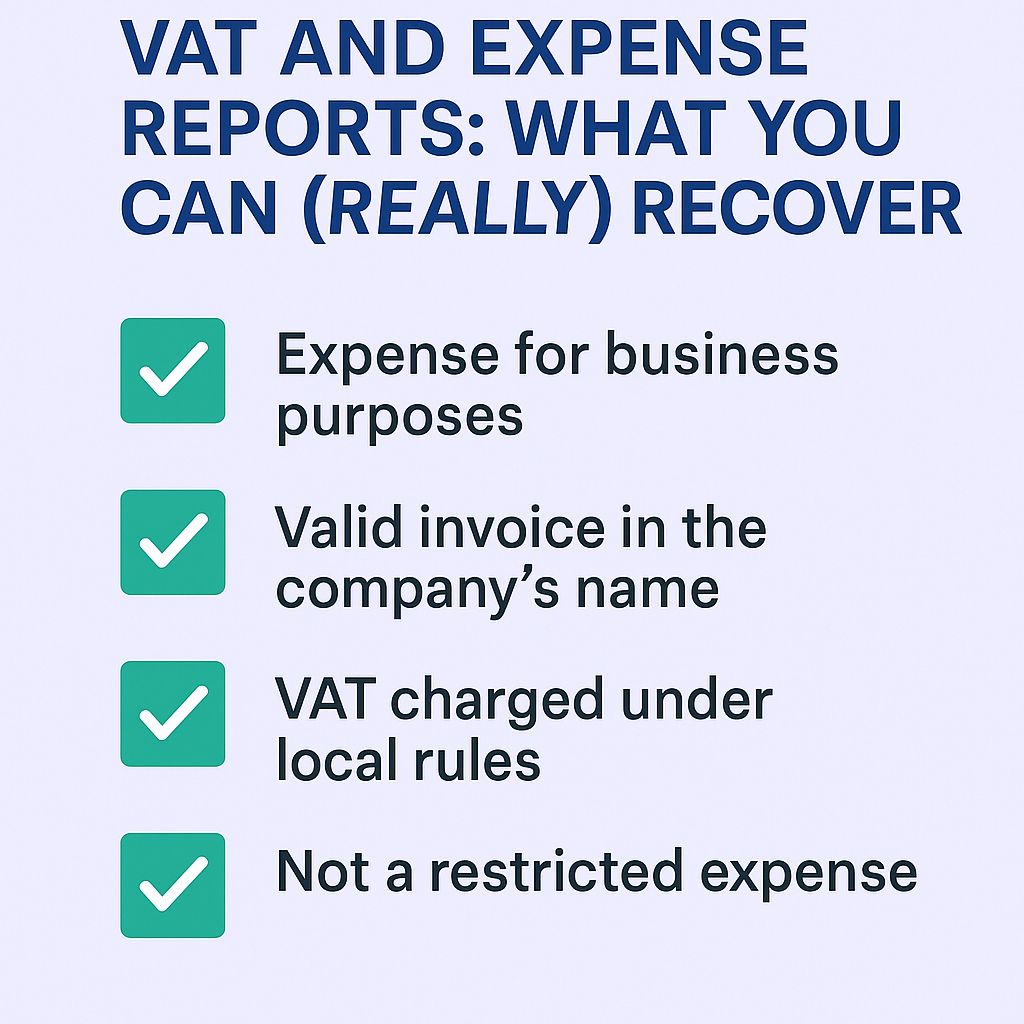

To recover VAT on an expense, the following conditions generally need to be met :

- ✅ The expense must be for business purposes

- ✅ A valid invoice is required, issued in the name of the company

- ✅ The VAT must be charged under local rules (foreign VAT often requires a different recovery process)

- ✅ The VAT must not fall into a restricted category (some expenses are simply non-deductible by law)

2. What You Can Recover: Real-Life Examples

Let’s break down some common expense categories and their VAT recovery status :

| Expense Type | VAT Recovery? | Comments |

|---|---|---|

| Hotel accommodation | ✅ Yes | Must be for a business trip; VAT on breakfast usually not deductible in some countries (e.g., France) |

| Business meals (clients) | ❌ No | Generally considered entertainment and excluded, unless specific exceptions apply |

| Employee meals (travel-related) | ✅ Yes | If employee is away on a professional trip |

| Taxi/Uber | ❌ No or Partial | Depends on jurisdiction and type of invoice |

| Fuel (diesel/gasoline) | ✅/Partial | Recovery depends on vehicle type (commercial vs. passenger) |

| Tolls and parking | ✅ Yes | If documented properly |

| Public transport | ❌ No or Limited | Often not subject to VAT or non-deductible |

| Airfare/train tickets | ❌ Often no | VAT often not applied, or ticket is exempt |

3. Common Mistakes That Cost You VAT

Even when the expense is technically deductible, errors in process or documentation can void your right to recovery :

- ❌ Missing or incomplete invoices (e.g. just a credit card receipt)

- ❌ Invoice issued in the employee’s name instead of the company’s

- ❌ Claiming VAT on non-deductible expenses (e.g. gifts, alcohol, entertainment)

- ❌ Incorrect coding or GL account allocation in the accounting system

4. How to Maximize VAT Recovery on Expenses

Here are some actionable steps your company can take :

- Educate your staff on which expenses are eligible and what documentation is required

- Set up digital workflows that validate expense reports before processing

- Work with accounting and tax advisors to periodically audit your expense claims

- Use expense software that supports VAT logic and tracks compliant invoices

Conclusion : Small Details, Big Impact

While expense-related VAT might seem like small change compared to other VAT flows, it can add up to significant savings—especially for companies with frequent travel and decentralized teams. Ensuring compliance and consistency in expense reporting not only reduces risk but also optimizes cash flow.

Don’t let reclaimable VAT slip away. A bit of discipline and automation can go a long way.

Drop a comment or reach out — I’d love to hear your perspective.

✉️ Need Help?

If you need a VAT review, a team training, or help optimizing your processes, feel free to reach out. We help businesses turn VAT from a liability into a strength.

📩 [Your Name / Contact Info / Description of services needed]

Get a personnal quote !

Leave a comment